Have you ever noticed an odd charge on your bank or credit card statement from a company called “Probiller”? If you’re scratching your head wondering what that charge is, you’re not alone. Many consumers are perplexed when they spot this vague charge amidst their other transactions.

So what exactly is Probiller, and why might you see a charge from them on your statement?

An Introduction to Probiller

Probiller is an online payment processor and subscription management service catering to a wide variety of merchants and digital service providers globally. They handle billing, payments, and subscriptions for third-party companies across many industries.

Some of the main types of sites and platforms that rely on Probiller’s payment processing services include:

- Adult entertainment and dating sites

- Video streaming services

- Antivirus and security software

- Virtual private networks (VPNs)

- Gaming platforms and in-game purchases

- Mobile apps and software downloads

When you sign up for trials, subscriptions, or make purchases on many sites, Probiller often handles processing the payments in the background.

So if you notice a Probiller charge on your bank statement, it likely relates to one of these types of services.

Read more about Uber Charge on Bank Statement

Why Do You See Probiller Charges?

There are a few reasons why mysterious Probiller fees or transactions may show up on your bank account or credit card statements periodically:

1. You Signed Up for a Trial or Subscription and Forgot

Oftentimes, Probiller charges occur because you signed up for a free trial or subscription through a site using their payment processing at some point but then forgot about it.

For example, maybe you registered for a 3-day free trial of an adult site or signed up for a monthly video streaming service. If you input your payment information at the time, recurring Probiller charges are likely once the trial converts to a paid plan or the next monthly billing cycle hits.

2. You Don’t Recognize the Service You’re Being Billed For

Another possibility is that you signed up for something that uses Probiller payments, but the vague, generic charge description they use on bank statements makes it difficult to determine what exactly the fee relates to.

Without a more detailed descriptor, it can be confusing trying to figure out what site, service, or transaction the Probiller charge connects to.

Read this article if you want to know Banks that are Open Today in the UK

3. You Were Signed Up Without Your Consent

While rare, some users have reported cases where sites enrolled them in memberships or subscriptions without their permission and used Probiller to process the unauthorized payments.

This fraudulent activity is not Probiller’s doing directly but rather deceptive practices of specific merchants abusing their payment platform. However, unfair charges can still end up on your statement.

4. Someone Else Used Your Payment Method to Sign Up

In some instances, a family member or partner may have signed up for something using your saved bank account or payment information, triggering recurring Probiller transaction fees.

Children making in-app purchases or partners registering for sites unbeknownst to you could explain some mystery charges.

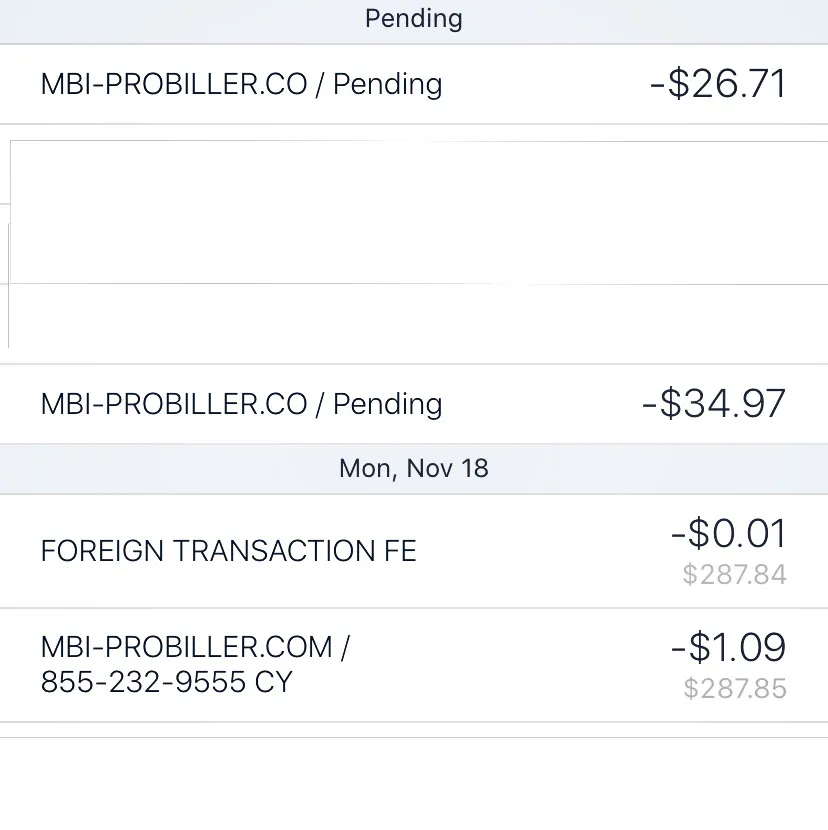

Probiller charges on your bank statement example:

- Probiller.com

- ProbillerEU

- PBILLER.COM

- Nutaku.net (Probiller)

- MBI-PROBILLER.COM 8552337555

- MBI*PROBILLER.COM/DP 855-232-9565 DE

- MBI-PROBILLER.COM/BZ +18552329675

- MBI-PROBILLER.COM/MN 855-232-9586

- MBI*PROBILLER.COM/DP 8552329552 DE

- MBI*PROBILLER.COM/RK 877-446-0668

- MBI*PROBILLER.COM/MF 8552329584 DE

- MBI*PROBILLER.COM 866-449-9191 DE

Read this article if you don’t know about what is a Score in Money

What to Do About Suspicious or Unauthorized Probiller Charges

If you discover Probiller charges on your statements that you don’t recognize or believe to be fraudulent, here are some important steps to take:

- Review Recent Statements and Emails – Check bank statements and inboxes for any references to which service or transaction the Probiller charge relates to. Any confirmation emails from sites you registered with might shed light.

- Cancel Unwanted Subscriptions – If you determine the charge is from a legitimate site but want to halt future billings, log into the site’s account portal and cancel the subscription if unwanted. This will stop recurring Probiller payments going forward.

- Dispute Invalid Charges – If charges are unauthorized or fraudulent, notify your bank or credit card provider immediately to dispute them and potentially receive reimbursement. Provide any evidence you have.

- Secure Your Accounts – Change account passwords, set up two-factor authentication, and monitor statements routinely to catch any further suspicious activity indicating compromised payment information.

Read this article if you see HFT ePay Charge on Your Bank Statement

Preventing Surprise Probiller Fees

To help avoid bewildering Probiller charges popping up in the future, keep these precautionary measures in mind:

- Be wary of free trials that require entering payment details upfront. They often convert to paid plans automatically. Set reminders to review and cancel before you get billed.

- When possible, use virtual credit card numbers or prepaid cards with limited funds on them to sign up for free trials. This way, recurring billings won’t go through.

- Note each site and service connected to your various payment methods. This makes it easier to identify charges in statements later.

- Set calendar reminders to audit statements and double check for unused or unwanted subscriptions that may be renewing and billing you periodically.

Read this article if you see FID BKG SVC LLC Charge on Your Bank Statement

What Recourse Exists If You’re Charged by Probiller?

If you find yourself the victim of fraudulent Probiller charges or unfair billing practices from one of their merchant partners, here are some potential forms of recourse:

- Dispute Charges – Notify your bank or credit card provider to challenge the charges. Provide any evidence that they are invalid or unauthorized transactions.

- File Complaints – Submit complaints to bureaus like the FTC or BBB detailing unfair business practices by the company responsible.

- Leave Reviews – Leave negative reviews about the experience on sites like Trustpilot alerting others of shady sign-up tactics or surprise charges.

- Contact Support – You can try contacting Probiller’s customer support team for questions or concerns related to charges as well.

The Takeaway: Monitor Statements and Vet Sites Carefully

Getting hit with a sudden Probiller charge out of the blue can be alarming. However, being vigilant about checking bank statement line items routinely and exercising caution when entering payment information on unfamiliar sites can prevent many unexpected charges.

If you do spot unrecognized Probiller transactions, take prompt action to cancel unwanted subscriptions or dispute invalid ones. While reputable in most cases, Probiller’s billing practices primarily come down to the trustworthiness of their individual merchant partners. Review sites thoroughly, read the fine print, and reach out for support if charges ever appear unauthorized or questionable.

Daniel, a seasoned professional with over 5 years of experience in banking, property, and finance, brings a wealth of expertise to the table. This authoritative blog is meticulously curated to provide you with the most up-to-date financial insights. Delving into the dynamic realms of banking and mortgages, Daniel’s passion for finances shines through every post.